Liberal Forum

Archive

‹

Political Chat Rooms

‹

No Holds Barred Political Forum

‹

"Cause He Understands Bidness, You See...."

"Cause He Understands Bidness, You See...."

By Blackvegetable

15 Apr 2025 6:51 am in No Holds Barred Political Forum

18 posts • Page 1 of 1

15 Apr 2025 6:51 am

https://www.bloomberg.com/news/articles ... poll-shows

Investor sentiment regarding economic prospects is the most negative in three decades, yet fund managers’ pessimism isn’t fully reflected in their asset allocation which could mean more losses for US stocks, a Bank of America Corp. survey shows.

Fund managers are extremely gloomy, with 82% of respondents to BofA’s monthly survey expecting the global economy to weaken. Consequently, a record number intend to reduce exposure to US equities, according to the poll.Fund mangers are “max bearish on macro, not quite max bearish on the market,” strategists led by Michael Hartnett wrote in a note.

“Peak fear” is not yet reflected in cash allocations, which currently stands at 4.8% of assets and would typically need to rise to 6%, they added.

Fondler,

Tell everyone what "max bearish on macro" means.

Feel free to chime in

@Zeets2

@ROG62

Investor sentiment regarding economic prospects is the most negative in three decades, yet fund managers’ pessimism isn’t fully reflected in their asset allocation which could mean more losses for US stocks, a Bank of America Corp. survey shows.

Fund managers are extremely gloomy, with 82% of respondents to BofA’s monthly survey expecting the global economy to weaken. Consequently, a record number intend to reduce exposure to US equities, according to the poll.Fund mangers are “max bearish on macro, not quite max bearish on the market,” strategists led by Michael Hartnett wrote in a note.

“Peak fear” is not yet reflected in cash allocations, which currently stands at 4.8% of assets and would typically need to rise to 6%, they added.

Fondler,

Tell everyone what "max bearish on macro" means.

Feel free to chime in

@Zeets2

@ROG62

15 Apr 2025 7:18 am

Blackvegetable » 15 Apr 2025, 6:51 am » wrote: ↑ https://www.bloomberg.com/news/articles ... poll-shows

Investor sentiment regarding economic prospects is the most negative in three decades, yet fund managers’ pessimism isn’t fully reflected in their asset allocation which could mean more losses for US stocks, a Bank of America Corp. survey shows.

Fund managers are extremely gloomy, with 82% of respondents to BofA’s monthly survey expecting the global economy to weaken. Consequently, a record number intend to reduce exposure to US equities, according to the poll.Fund mangers are “max bearish on macro, not quite max bearish on the market,” strategists led by Michael Hartnett wrote in a note.

“Peak fear” is not yet reflected in cash allocations, which currently stands at 4.8% of assets and would typically need to rise to 6%, they added.

Fondler,

Tell everyone what "max bearish on macro" means.

Feel free to chime in

@Zeets2

@ROG62

YOU claim you hold 4 FINRA licenses, so that's one YOU should know by heart, CUCKYBOY!!

WHY do you need someone SMARTER THAN YOU to explain that **** to you if YOU ARE AS SMART AS YOU CLAIM YOU ARE??

RUN!!

NOD!!

https://media.tenor.com/YebVIVDe700AAAA ... hiatus.gif

Liberals are spoiled children, miserable, unsatisfied, demanding, ill-disciplined, despotic & useless. Liberalism is a philosophy of sniveling brats ~O'Rourke

The Democratic Party seems intransigent on their position of keeping the party ‘woke,’ detached, exclusionary, and totally insane.

The Democratic Party seems intransigent on their position of keeping the party ‘woke,’ detached, exclusionary, and totally insane.

15 Apr 2025 8:36 am

Shouldn't you be putting a charge in that dead cat?*Beekeeper » 15 Apr 2025, 7:18 am » wrote: ↑ YOU claim you hold 4 FINRA licenses, so that's one YOU should know by heart, CUCKYBOY!!

WHY do you need someone SMARTER THAN YOU to explain that **** to you if YOU ARE AS SMART AS YOU CLAIM YOU ARE??

RUN!!

NOD!!

https://media.tenor.com/YebVIVDe700AAAA ... hiatus.gif

15 Apr 2025 9:30 am

Ah, there it is. Post a headline, copy a strategist quote, then demand definitions from everyone else like you’re moderating a spelling bee for adults. Another proud entry in the “Ask and Vanish” collection.Blackvegetable » 15 Apr 2025, 6:51 am » wrote: ↑ https://www.bloomberg.com/news/articles ... poll-shows

Investor sentiment regarding economic prospects is the most negative in three decades, yet fund managers’ pessimism isn’t fully reflected in their asset allocation which could mean more losses for US stocks, a Bank of America Corp. survey shows.

Fund managers are extremely gloomy, with 82% of respondents to BofA’s monthly survey expecting the global economy to weaken. Consequently, a record number intend to reduce exposure to US equities, according to the poll.Fund mangers are “max bearish on macro, not quite max bearish on the market,” strategists led by Michael Hartnett wrote in a note.

“Peak fear” is not yet reflected in cash allocations, which currently stands at 4.8% of assets and would typically need to rise to 6%, they added.

Fondler,

Tell everyone what "max bearish on macro" means.

Feel free to chime in

@Zeets2

@ROG62

But sure, since we're pretending this is a seminar and not dodge #81 in progress:

No rush. I fully expect the answer to be “post the OP” or “define macro.” Dodge #82 is warming up its legs right now.do you think fund managers' bearish macro outlook is justified by actual indicators, or is this just another herd-mentality overreaction fueled by short-term volatility and headlines?

Retarded Horse's view on women.

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

- I LOVE IT WHEN A CRACK WHORE GETS BEAT UP Image

- I WANT TO WATCH YOU BEAT YOUR CRACK WHORE WIFE Image Image Image

- PUT THAT WIFE BEATER ON AND GET BUSY

15 Apr 2025 9:31 am

Blackvegetable » 15 Apr 2025, 8:36 am » wrote: ↑ Shouldn't you be putting a charge in that dead cat?

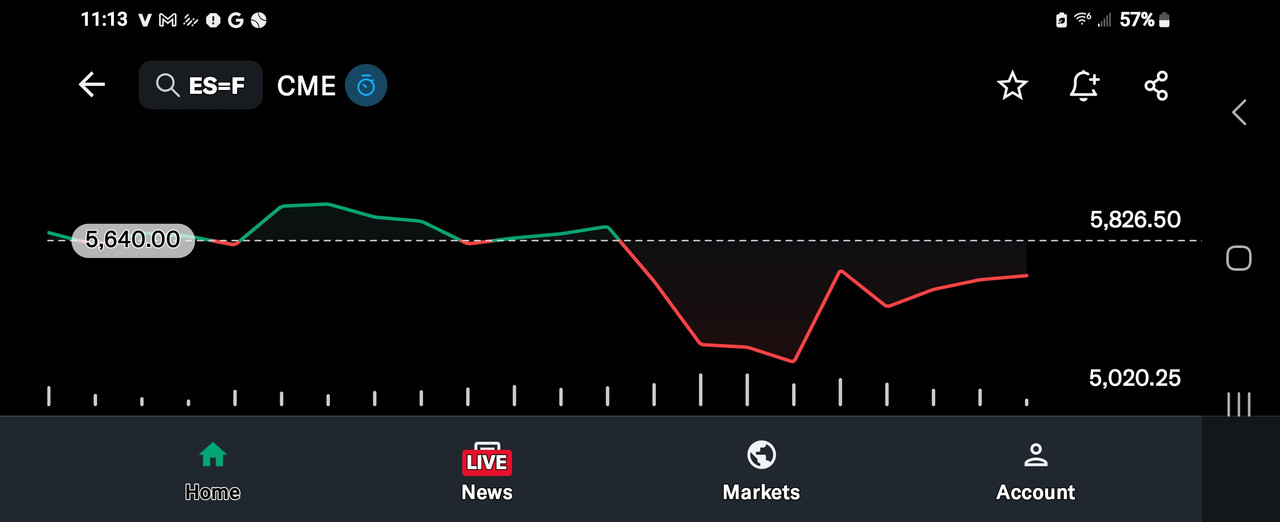

Markets have been UP over 5% ending last week. Heading up this morning.

Did you cat die already?? Try feeding it *******.

Please, run along with your nonsensical ****.

Liberals are spoiled children, miserable, unsatisfied, demanding, ill-disciplined, despotic & useless. Liberalism is a philosophy of sniveling brats ~O'Rourke

The Democratic Party seems intransigent on their position of keeping the party ‘woke,’ detached, exclusionary, and totally insane.

The Democratic Party seems intransigent on their position of keeping the party ‘woke,’ detached, exclusionary, and totally insane.

15 Apr 2025 10:14 am

Yipee!*Beekeeper » 15 Apr 2025, 9:31 am » wrote: ↑ Markets have been UP over 5% ending last week. Heading up this morning.

Did you cat die already?? Try feeding it *******.

Please, run along with your nonsensical ****.

15 Apr 2025 10:35 am

As fiduciaries (A distinction you can't be made to understand. Not that it is very difficult, mind you.) fund managers must manage their clients' monies in a defensible manner.Vegas » 15 Apr 2025, 9:30 am » wrote: ↑ Ah, there it is. Post a headline, copy a strategist quote, then demand definitions from everyone else like you’re moderating a spelling bee for adults. Another proud entry in the “Ask and Vanish” collection.

But sure, since we're pretending this is a seminar and not dodge #81 in progress:

No rush. I fully expect the answer to be “post the OP” or “define macro.” Dodge #82 is warming up its legs right now.

From the perspective of their incentives, being in cash produces a drag on returns.

(This is yet another of many concepts you are too stupid to grasp, so don't ask.) Accordingly, those with a history of acting on false signals now make their living appearing on FOX.

Acknowledge that you've been answered.

15 Apr 2025 10:47 am

Blackvegetable » 15 Apr 2025, 10:35 am » wrote: ↑ As fiduciaries (A distinction you can't be made to understand. Not that it is very difficult, mind you.) fund managers must manage their clients' monies in a defensible manner.

From the perspective of their incentives, being in cash produces a drag on returns.

(This is yet another of many concepts you are too stupid to grasp, so don't ask.) Accordingly, those with a history of acting on false signals now make their living appearing on FOX.

Acknowledge that you've been answered.

Oh, I acknowledge it, Mary. I acknowledge that you finally gave a half-answer... surrounded by more padding than a toddler in a bike helmet. You’re like a guy who hands in a homework assignment with “Don’t ask questions” written in the margins. You didn’t explain whether you agree with the fund managers’ macro view. You didn’t challenge or support the data. You just reminded us—again—that your favorite topic is your own imagined superiority.

Oh, I acknowledge it, Mary. I acknowledge that you finally gave a half-answer... surrounded by more padding than a toddler in a bike helmet. You’re like a guy who hands in a homework assignment with “Don’t ask questions” written in the margins. You didn’t explain whether you agree with the fund managers’ macro view. You didn’t challenge or support the data. You just reminded us—again—that your favorite topic is your own imagined superiority.Congrats on answering one question out of 82. We’ll hold a ceremony. Don’t forget your thesaurus. A half *** answer doesn't count, retard.

1. Flip it all around on me. The coward has to hide.

Retarded Horse's view on women.

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

- I LOVE IT WHEN A CRACK WHORE GETS BEAT UP Image

- I WANT TO WATCH YOU BEAT YOUR CRACK WHORE WIFE Image Image Image

- PUT THAT WIFE BEATER ON AND GET BUSY

15 Apr 2025 10:47 am

Blackvegetable » 15 Apr 2025, 10:35 am » wrote: ↑ As fiduciaries (A distinction you can't be made to understand. Not that it is very difficult, mind you.) fund managers must manage their clients' monies in a defensible manner.

From the perspective of their incentives, being in cash produces a drag on returns.

(This is yet another of many concepts you are too stupid to grasp, so don't ask.) Accordingly, those with a history of acting on false signals now make their living appearing on FOX.

Acknowledge that you've been answered.

YOU STILL HAVEN'T DEFINED THE TERM WOMAN

15 Apr 2025 10:52 am

Vegas » 15 Apr 2025, 9:30 am » wrote: ↑ Ah, there it is. Post a headline, copy a strategist quote, then demand definitions from everyone else like you’re moderating a spelling bee for adults. Another proud entry in the “Ask and Vanish” collection.

But sure, since we're pretending this is a seminar and not dodge #81 in progress:

No rush. I fully expect the answer to be “post the OP” or “define macro.” Dodge #82 is warming up its legs right now.

15 Apr 2025 11:11 am

Reading through the flatufog, is this your way of admitting that I am correct....and you in need?Vegas » 15 Apr 2025, 10:47 am » wrote: ↑Oh, I acknowledge it, Mary. I acknowledge that you finally gave a half-answer... surrounded by more padding than a toddler in a bike helmet. You’re like a guy who hands in a homework assignment with “Don’t ask questions” written in the margins. You didn’t explain whether you agree with the fund managers’ macro view. You didn’t challenge or support the data. You just reminded us—again—that your favorite topic is your own imagined superiority.

Congrats on answering one question out of 82. We’ll hold a ceremony. Don’t forget your thesaurus. A half *** answer doesn't count, retard.

1. Flip it all around on me. The coward has to hide.

15 Apr 2025 11:31 am

He has to end with a question, of course. just like I predicted - hid 100% accuracy.Blackvegetable » 15 Apr 2025, 11:11 am » wrote: ↑ Reading through the flatufog, is this your way of admitting that I am correct....and you in need?

So now we're making up words like flatufog and pretending that counts as clarity. Mary, if inventing nonsense terms was proof of victory, you’d be a Nobel laureate in gibberish.

No, I’m not admitting anything—except that you’re still on dodge #82, still allergic to direct answers, and still hoping that condescension will do the thinking for you. Keep dreaming, Word Wizard.

1. continue to hide...100% accuracy.

2. continue to dodge.

Retarded Horse's view on women.

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

- I LOVE IT WHEN A CRACK WHORE GETS BEAT UP Image

- I WANT TO WATCH YOU BEAT YOUR CRACK WHORE WIFE Image Image Image

- PUT THAT WIFE BEATER ON AND GET BUSY

15 Apr 2025 11:34 am

Why are you in a panic Dickhead?....Blackvegetable » 15 Apr 2025, 6:51 am » wrote: ↑ https://www.bloomberg.com/news/articles ... poll-shows

Investor sentiment regarding economic prospects is the most negative in three decades, yet fund managers’ pessimism isn’t fully reflected in their asset allocation which could mean more losses for US stocks, a Bank of America Corp. survey shows.

Fund managers are extremely gloomy, with 82% of respondents to BofA’s monthly survey expecting the global economy to weaken. Consequently, a record number intend to reduce exposure to US equities, according to the poll.Fund mangers are “max bearish on macro, not quite max bearish on the market,” strategists led by Michael Hartnett wrote in a note.

“Peak fear” is not yet reflected in cash allocations, which currently stands at 4.8% of assets and would typically need to rise to 6%, they added.

Fondler,

Tell everyone what "max bearish on macro" means.

Feel free to chime in

@Zeets2

@ROG62

Afraid your $3.00 portfolio might lose .27

15 Apr 2025 11:41 am

I gave a you correct, direct, and pithy answer....as is my wont.Vegas » 15 Apr 2025, 11:31 am » wrote: ↑ He has to end with a question, of course. just like I predicted - hid 100% accuracy.

So now we're making up words like flatufog and pretending that counts as clarity. Mary, if inventing nonsense terms was proof of victory, you’d be a Nobel laureate in gibberish.

No, I’m not admitting anything—except that you’re still on dodge #82, still allergic to direct answers, and still hoping that condescension will do the thinking for you. Keep dreaming, Word Wizard.

1. continue to hide...100% accuracy.

2. continue to dodge.

I even identified the elements no one would live long enough to make you understand.

That's serious Level 16 ****....

How many orders of magnitude better than you is that?

15 Apr 2025 11:55 am

Mary, let’s break down that “Level 16” performance, shall we? Because for all the puffed-up language, what you didn’t do is exactly why you're still on dodge #82.Blackvegetable » 15 Apr 2025, 11:41 am » wrote: ↑ I gave a you correct, direct, and pithy answer....as is my wont.

I even identified the elements no one would live long enough to make you understand.

That's serious Level 16 ****....

How many orders of magnitude better than you is that?

Here’s what I asked you disgusting excuse for a human being:

Here’s what you actually did instead, moron:Do you personally believe the fund managers’ bearish macro outlook is justified by actual economic indicators—or is it just another herd-driven panic?

- Gave a vague general statement about fiduciaries and incentives (textbook deflection). VAGUE is your middle name and most comment deflection tactic.

- Tossed in an insult about how I “couldn’t understand it anyway” (classic preemptive shield).

- Made no mention of whether YOU OR DISAGREE with the fund managers’ sentiment.

- Never addressed actual indicators like inflation, GDP, consumer spending, or earnings projections...that would require numbers We both know how you are with anything that involves numeracy.

Retarded Horse's view on women.

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

- I LOVE IT WHEN A CRACK WHORE GETS BEAT UP Image

- I WANT TO WATCH YOU BEAT YOUR CRACK WHORE WIFE Image Image Image

- PUT THAT WIFE BEATER ON AND GET BUSY

15 Apr 2025 12:29 pm

I think it best, given your intuitive suspicion of your ethnocongenital inferiority, that you tell me how much you know about money management (obviously "Not a **** thing, Veg. I am an AI dependent moron.") so I may tailor my response to your sub Level 0.16 comprehension.Vegas » 15 Apr 2025, 11:55 am » wrote: ↑ Mary, let’s break down that “Level 16” performance, shall we? Because for all the puffed-up language, what you didn’t do is exactly why you're still on dodge #82.

Here’s what I asked you disgusting excuse for a human being:

Here’s what you actually did instead, moron:That’s not answering a question—that’s spray-painting arrogance on the wall and running away. So no, Mary, you didn’t clear the level. You rage-quit the boss fight and declared yourself the winner. Again.

- Gave a vague general statement about fiduciaries and incentives (textbook deflection). VAGUE is your middle name and most comment deflection tactic.

- Tossed in an insult about how I “couldn’t understand it anyway” (classic preemptive shield).

- Made no mention of whether YOU OR DISAGREE with the fund managers’ sentiment.

- Never addressed actual indicators like inflation, GDP, consumer spending, or earnings projections...that would require numbers We both know how you are with anything that involves numeracy.

15 Apr 2025 12:42 pm

Flips it on me. As [predicted. 100% accuracy—dodge #83, now wrapped in pseudo-academic gibberish and topped with the desperate accusation that I used AI to troll you. Hate to break it to you, Mary, but AI doesn’t troll people—it’s programmed not to. If you bothered to research AI, you would know. That level of personal antagonism? That’s all natural, handcrafted sarcasm—just for you.Blackvegetable » 15 Apr 2025, 12:29 pm » wrote: ↑ I think it best, given your intuitive suspicion of your ethnocongenital inferiority, that you tell me how much you know about money management (obviously "Not a **** thing, Veg. I am an AI dependent moron.") so I may tailor my response to your sub Level 0.16 comprehension.

And no, I didn’t outsource the question. You’re just that predictable. You post a thread, throw in some foggy elitist monologue, and when asked for real analysis, you melt into insult poetry and imaginary IQ scales.

But hey, keep dodging. You’ve nearly unlocked Platinum Tier Evasion—just one more incoherent reply and you're there.

1. Continue to flip it on me instead of answering.

2. Post another "Are these your words" of me admitting to the AI induced OP. Thereby, deliberately ignoring the 'it can't troll' part.

Retarded Horse's view on women.

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

- I LOVE IT WHEN A CRACK WHORE GETS BEAT UP Image

- I WANT TO WATCH YOU BEAT YOUR CRACK WHORE WIFE Image Image Image

- PUT THAT WIFE BEATER ON AND GET BUSY

15 Apr 2025 1:59 pm

@*VegasVagina

Your bitterness at my prodigious vocabulary is understandable but English, in its abundant variety, allows for a precision which suits my pitiless style. That it triggers your ready sense of geneological grievance is just a bonus.

Your bitterness at my prodigious vocabulary is understandable but English, in its abundant variety, allows for a precision which suits my pitiless style. That it triggers your ready sense of geneological grievance is just a bonus.

18 posts • Page 1 of 1

Who is online

In total there are 1666 users online :: 18 registered, 17 bots, and 1631 guests

Registered users: Vegas, roadkill, Blackvegetable, Buck Naked, righteous, ROG62, ConservativeWave, *GHETTO BLASTER, MR-7, jerra b, Skans, EDC4ALL!, Punch, murdock, Cannonpointer, Harper Lee, nefarious101, 31st Arrival

Bots: LCC, Not, Google-Apps-Scrip, CriteoBot, YandexBot, proximic, semantic-visions.com, Mediapartners-Google, Applebot, app.hypefactors.com, ADmantX, Feedfetcher-Google, linkfluence.com, Googlebot, curl/7, BLEXBot, bingbot