Liberal Forum

Archive

‹

Political Chat Rooms

‹

No Holds Barred Political Forum

‹

Fuelman, here’s more confirmation of the “melt-up” that’s coming!

Fuelman, here’s more confirmation of the “melt-up” that’s coming!

By LowIQTrash

3 Aug 2024 1:10 pm in No Holds Barred Political Forum

24 Aug 2024 12:35 pm

Was up 60% overall back in early June. Account tanked after. Currently recovering.Fuelman » 24 Aug 2024, 8:32 am » wrote: ↑ No, not paying much attention. The benefit of long term investing.

So how is it going with the options trading? Your goal was to double or triple your trading account. Making any headway?

It would have been better to just stick to long term buying shares. However, I am confident I can be one of the extreme minority that can “make it.”

Buying options is kind of like going to war with a small army.

24 Aug 2024 12:42 pm

Just as both parties do and have done for a hundred years, now.Zeets2 » 24 Aug 2024, 11:11 am » wrote: ↑ ...just like the government has been doing under Biden/Harris!

The republican party absolutely HATES Trump. They are FORCED to play nice, by the voters. If the voters were not fiercely loyal to Trump, the Lindsey Grahams and Ted Cruises would wipe their asses with him.

And the republican party sucks wall street's ***. The dems have just gotten better at it, lately.

"Because I SAY I am" is fallacy, not science

You cannot betray me - only yourself, to me.

Who cuts off your dick is not your friend

An opinion you won't defend is not yours. It's someone else's.

Humanity's Law of the Jungle: Survival NOT of the fittest, but of the tribe.

When peeing in the pool, stand on the edge.

Only religions declare heresy; only lies require protection.

If gender is not sex, why should a gender claim change what sex you shower with?

You cannot betray me - only yourself, to me.

Who cuts off your dick is not your friend

An opinion you won't defend is not yours. It's someone else's.

Humanity's Law of the Jungle: Survival NOT of the fittest, but of the tribe.

When peeing in the pool, stand on the edge.

Only religions declare heresy; only lies require protection.

If gender is not sex, why should a gender claim change what sex you shower with?

24 Aug 2024 1:55 pm

One of the biggest mistakes I made during that time frame was dumping more cash into the trading account without the track record to support the additional infusion of money. A $25k loss turned into a $50k loss.LowIQTrash » 24 Aug 2024, 12:35 pm » wrote: ↑ Was up 60% overall back in early June. Account tanked after. Currently recovering.

It would have been better to just stick to long term buying shares. However, I am confident I can be one of the extreme minority that can “make it.”

Buying options is kind of like going to war with a small army.The big money guys typically sell options instead for “passive income.”

It's a game for deep pockets.

Hopefully you have access to a 401k with a company match. 10-15 years of being diligent will get you to a comfortable place. Probably not the **** you balance you were hoping for but I can guarantee you you will be happy you did. Max it out!

24 Aug 2024 1:58 pm

The lure of fast money takes it's toll on a lot of people.ROG62 » 24 Aug 2024, 12:18 pm » wrote: ↑ Long term exactly...

I'm sure he wins every time he's in Vegas too...

24 Aug 2024 6:30 pm

totally...

24 Aug 2024 6:33 pm

The turtle and the hare comes to mind...you'll end up old and poor (by your standards)...LowIQTrash » 24 Aug 2024, 12:35 pm » wrote: ↑ Was up 60% overall back in early June. Account tanked after. Currently recovering.

It would have been better to just stick to long term buying shares. However, I am confident I can be one of the extreme minority that can “make it.”

Buying options is kind of like going to war with a small army.The big money guys typically sell options instead for “passive income.”

25 Aug 2024 4:44 pm

We’ll see. I haven’t lost nor given up yet.ROG62 » 24 Aug 2024, 6:33 pm » wrote: ↑ The turtle and the hare comes to mind...you'll end up old and poor (by your standards)...

25 Aug 2024 4:46 pm

I believe getting rich fast is doable. Some university kids in Utah (where I was 5 years ago) started some cookie franchise (Crumbl) and are now worth 8 figures 7 years later. I realized early on I don’t have a charismatic personality so selling is not my strength.Fuelman » 24 Aug 2024, 1:55 pm » wrote: ↑ One of the biggest mistakes I made during that time frame was dumping more cash into the trading account without the track record to support the additional infusion of money. A $25k loss turned into a $50k loss.

It's a game for deep pockets.

Hopefully you have access to a 401k with a company match. 10-15 years of being diligent will get you to a comfortable place. Probably not the **** you balance you were hoping for but I can guarantee you you will be happy you did. Max it out!

Nobody ever said this was going to be easy.

26 Aug 2024 7:06 am

Good "luck"...

26 Aug 2024 9:26 am

All I'm saying is, know your limits and have plan B working in the background.LowIQTrash » 25 Aug 2024, 4:46 pm » wrote: ↑ I believe getting rich fast is doable. Some university kids in Utah (where I was 5 years ago) started some cookie franchise (Crumbl) and are now worth 8 figures 7 years later. I realized early on I don’t have a charismatic personality so selling is not my strength.

Nobody ever said this was going to be easy.

7 Sep 2024 12:41 am

I am back for round B!Fuelman » 26 Aug 2024, 9:26 am » wrote: ↑ All I'm saying is, know your limits and have plan B working in the background.

So I said earlier that I expected a "melt-up," (I did not make any trades based on that assumption) yet I am forced to retract the prediction because the market is behaving in ways that...well, let's just say are likely to do the exact opposite.

We are going to have a MELT DOWN in Sept - Nov. That is my new prediction

Reasons / evidence:

1. Buffett is selling billions of dollars worth of stocks like there is no tomorrow. (Any news article will confirm this)

Red flag #1

2. Ominous pattern in the SP 500 index

I have seen even veteran traders (mind you, I only have a few months of experience as I did not actively participate/analyze market trades until sometime in June 2024) miss this little detail:

1 looks like a set of diagonal stairs down, with some buyers stepping in to buy along the way (those upward spikes).

2, the current selloff we're in, has seen ZERO upward (counter) spikes.

What this means is that...NO BUYERS ARE STEPPING IN!

-----------------------------

Institutional investors like hedge funds, sovereign wealth funds, government pensions, etc. move the market with their trillions of dollars. Retail and individual traders do not have enough buying power to do so.

What is likely going on is that a bunch of institutional investors are TRYING to offload TRILLIONS worth of stocks onto other investors, but institutional investors are currently smart enough to NOT take the bait here. The real problem is that ONLY OTHER institutional investors have enough buying power to buy shares to keep prices afloat.

Only [idiotic] retail traders who flood into the stock market near its peak are buying en masse ("BUY THE DIP man!!!!!"). Because retail doesn't have enough buying power to arrest the decline of the stock price, you cannot even SEE those upward spikes (on the minute chart, they exist, but are too small to witness on the daily chart).

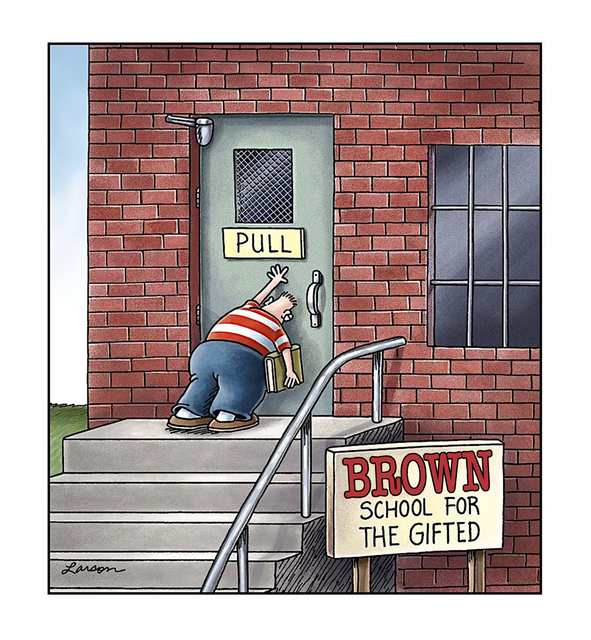

Pattern 2 looks like a waterfall, much like this one:

(HUGE RED FLAG #2)

3. Options shenanigans

https://pbs.twimg.com/media/GV3ThpwWwAA ... name=large

Let me explain what's going on:

9/20/24 is 2 days after J Powell's (The Fed's) decision on how many basis points to cut in terms of rates. The fact that there is 2.4 million interest (desire to place an order) in put options 2 DAYS after the Fed's decision is very concerning.

Let's assume each contract expiring on this date is worth around $300 on average (I checked the ranges for reasonable strike prices, they're like $200 - $600, so I used a conservative $300).

$300 x 2.4 million in interest = over $700 million dollars in put options interest

Now do you think all these anonymous people are "gambling" with $700+ MILLION or...maybe they know something that we little peons don't??!

RED FLAG #3

Conclusion:

I am going ALL IN with PUT options, expiring in December.

I will be focused on sectors/stocks that will likely drop more - small caps (IWM), consumer cyclical (retail/restaurants), tech.

This market is going to crash and we will see a

8 Sep 2024 7:06 am

Historically, September is usually a down month for the markets so you may have some luck.LowIQTrash » 07 Sep 2024, 12:41 am » wrote: ↑ I am back for round B!

So I said earlier that I expected a "melt-up," (I did not make any trades based on that assumption) yet I am forced to retract the prediction because the market is behaving in ways that...well, let's just say are likely to do the exact opposite.

We are going to have a MELT DOWN in Sept - Nov. That is my new prediction

Reasons / evidence:

1. Buffett is selling billions of dollars worth of stocks like there is no tomorrow. (Any news article will confirm this)

Red flag #1

2. Ominous pattern in the SP 500 index

I have seen even veteran traders (mind you, I only have a few months of experience as I did not actively participate/analyze market trades until sometime in June 2024) miss this little detail:

1 looks like a set of diagonal stairs down, with some buyers stepping in to buy along the way (those upward spikes).

2, the current selloff we're in, has seen ZERO upward (counter) spikes.

What this means is that...NO BUYERS ARE STEPPING IN!

-----------------------------

Institutional investors like hedge funds, sovereign wealth funds, government pensions, etc. move the market with their trillions of dollars. Retail and individual traders do not have enough buying power to do so.

What is likely going on is that a bunch of institutional investors are TRYING to offload TRILLIONS worth of stocks onto other investors, but institutional investors are currently smart enough to NOT take the bait here. The real problem is that ONLY OTHER institutional investors have enough buying power to buy shares to keep prices afloat.

Only [idiotic] retail traders who flood into the stock market near its peak are buying en masse ("BUY THE DIP man!!!!!"). Because retail doesn't have enough buying power to arrest the decline of the stock price, you cannot even SEE those upward spikes (on the minute chart, they exist, but are too small to witness on the daily chart).

Pattern 2 looks like a waterfall, much like this one:

(HUGE RED FLAG #2)

3. Options shenanigans

https://pbs.twimg.com/media/GV3ThpwWwAA ... name=large

Let me explain what's going on:

9/20/24 is 2 days after J Powell's (The Fed's) decision on how many basis points to cut in terms of rates. The fact that there is 2.4 million interest (desire to place an order) in put options 2 DAYS after the Fed's decision is very concerning.

Let's assume each contract expiring on this date is worth around $300 on average (I checked the ranges for reasonable strike prices, they're like $200 - $600, so I used a conservative $300).

$300 x 2.4 million in interest = over $700 million dollars in put options interest

Now do you think all these anonymous people are "gambling" with $700+ MILLION or...maybe they know something that we little peons don't??!

RED FLAG #3

Conclusion:

I am going ALL IN with PUT options, expiring in December.

I will be focused on sectors/stocks that will likely drop more - small caps (IWM), consumer cyclical (retail/restaurants), tech.

This market is going to crash and we will see a

Pull the trigger and see what happens. It's the only way to know for sure if your research stands up.

8 Sep 2024 7:29 am

8 Sep 2024 8:32 am

Seasonality definitely plays a part.Fuelman » 08 Sep 2024, 7:29 am » wrote: ↑ You might find this interesting:

https://www.businessinsider.com/stock-m ... old-2024-9

The problem right now that I’ve noticed is the overwhelming majority of retail believe Powell will cut 25-50 bp and this will cause the market to soar. I’m skeptical at this point and will be monitoring any signs or clues that this won’t materialize. This smells like a sell-the-news event.

I will be dipping SLOWLY into puts. I have a set of parameters, which if met would serve as confirmation of a very serious crash.

(FOR ANYONE READING THIS: ONLY RISK WHAT YOU CAN AFFORD TO LOSE IF YOU’re FOLLOWING)

Given my luck this will make a V shape recovery next week and all my plans thrown out a window.

9 Sep 2024 7:40 am

Market Futures looking fairly strong this morning.LowIQTrash » 08 Sep 2024, 8:32 am » wrote: ↑ Seasonality definitely plays a part.

The problem right now that I’ve noticed is the overwhelming majority of retail believe Powell will cut 25-50 bp and this will cause the market to soar. I’m skeptical at this point and will be monitoring any signs or clues that this won’t materialize. This smells like a sell-the-news event.

I will be dipping SLOWLY into puts. I have a set of parameters, which if met would serve as confirmation of a very serious crash.

(FOR ANYONE READING THIS: ONLY RISK WHAT YOU CAN AFFORD TO LOSE IF YOU’re FOLLOWING)

Given my luck this will make a V shape recovery next week and all my plans thrown out a window.

Came across an article this morning talking about market surges of 10% or more and what months they occur. A full 30% of them happened from October till end of year. Not exactly sure why I read that stuff but historicals seem to be relevant in the mix.

This weekend retirement account check showed us up a whopping 11% after fees so far this year. Not very exciting but still a significant amount of money. Like I said, we are only seeking 7% increases for the next few years to reach the 7 digit balance. Might happen, might not!

I've come to the conclusion that all the rationalizing in the world cannot predict where the markets will go. Those computers make those decisions in nano seconds so at this point I just ride the waves up and down.

9 Sep 2024 4:10 pm

(bolded) You might want to stow that optimistic predictionFuelman » 09 Sep 2024, 7:40 am » wrote: ↑ Market Futures looking fairly strong this morning.

Came across an article this morning talking about market surges of 10% or more and what months they occur. A full 30% of them happened from October till end of year. Not exactly sure why I read that stuff but historicals seem to be relevant in the mix.

This weekend retirement account check showed us up a whopping 11% after fees so far this year. Not very exciting but still a significant amount of money.

Like I said, we are only seeking 7% increases for the next few years to reach the 7 digit balance. Might happen, might not!

I've come to the conclusion that all the rationalizing in the world cannot predict where the markets will go. Those computers make those decisions in nano seconds so at this point I just ride the waves up and down.

(Start at 4:30 and watch to 5:30)

https://youtu.be/67JAv6dYUU4?t=271

"Bull markets make money, bear markets make fortunes." ~Wall St creed

If you can't/don't want to time shorts, you're going to have to stick with gov't bonds soon, there are not many alternatives.

Even if my (current) prediction fails, I believe the latest the market will peak is June 2025. (In fact, I have been debating some people who are way more technically experienced and I think there is going to be at least one more fierce rally, so my timing is off again * sigh *.

At least I didn't enter any of my intended positions

I don't know what % of your liquid NW you keep in CDs or savings accounts but I don't see a point when short term bond yields are equivalent and aren't at risk of bank runs / financial collapses. Most people are seriously underestimating how dangerous these unrealized losses are on banks' balance sheets.

9 Sep 2024 4:39 pm

Being optimistic let's me sleep at night!LowIQTrash » 09 Sep 2024, 4:10 pm » wrote: ↑ (bolded) You might want to stow that optimistic prediction

(Start at 4:30 and watch to 5:30)

https://youtu.be/67JAv6dYUU4?t=271

"Bull markets make money, bear markets make fortunes." ~Wall St creed

If you can't/don't want to time shorts, you're going to have to stick with gov't bonds soon, there are not many alternatives. Even if my (current) prediction fails, I believe the latest the market will peak is June 2025 (Almost certainly much sooner).

No point in laddering CDs when bond yields are equivalent and aren't at risk of bank runs / financial collapses.

Interesting video, like I said, historicals are an advantage for those really keeping an eye on things. I'll keep this in mind as we are in a moderate risk portfolio. It wouldn't hurt too much to be more conservative.

Thanks for info! Never know what you will come across on NHB.

10 Sep 2024 8:54 pm

I would say we are following the blueprint in 2007 quite well so far. Fed cut rates in 2007 and there was a temporary surge in stock prices.Fuelman » 09 Sep 2024, 4:39 pm » wrote: ↑ Being optimistic let's me sleep at night!

Interesting video, like I said, historicals are an advantage for those really keeping an eye on things. I'll keep this in mind as we are in a moderate risk portfolio. It wouldn't hurt too much to be more conservative.

Thanks for info! Never know what you will come across on NHB.

Despite deteriorating conditions, the market stayed afloat / sort of meandered back and forth all the way until September 2008. Go figure.

Michael Burry's credit default swaps lost 50% of their value and his clients were sending him angry emails / threatening him with lawsuits / possible bodily harm.

It's always nice to have someone such as yourself remind me of the dangers of mis-timing short positions!

11 Sep 2024 8:28 am

Curious if you are looking at "in the money" puts/calls or "out of the money" puts/calls?LowIQTrash » 10 Sep 2024, 8:54 pm » wrote: ↑ I would say we are following the blueprint in 2007 quite well so far. Fed cut rates in 2007 and there was a temporary surge in stock prices.

Despite deteriorating conditions, the market stayed afloat / sort of meandered back and forth all the way until September 2008. Go figure.

Michael Burry's credit default swaps lost 50% of their value and his clients were sending him angry emails / threatening him with lawsuits / possible bodily harm.

It's always nice to have someone such as yourself remind me of the dangers of mis-timing short positions!

I imagine the get rich quick crowd focuses on out of the money options as the profits can be much greater percentage wise but they do come with much greater risk.

You are probably farther along than the rookie stage but it's always wise to remember the basics.

https://youtu.be/pmIrKQLOLLE?si=bIoL978m4uAdBDcO

11 Sep 2024 12:01 pm

I play OTM but I should be doing at least 50/50.Fuelman » 11 Sep 2024, 8:28 am » wrote: ↑ Curious if you are looking at "in the money" puts/calls or "out of the money" puts/calls?

I imagine the get rich quick crowd focuses on out of the money options as the profits can be much greater percentage wise but they do come with much greater risk.

You are probably farther along than the rookie stage but it's always wise to remember the basics.

https://youtu.be/pmIrKQLOLLE?si=bIoL978m4uAdBDcO

Yes, I imagine I am no longer a beginner…I would never do one of those WallStBet type plays where they gamble everything on earnings and then either brag about +300% in one day or post losses of 90%

I would say the biggest lesson I’ve learned is to wait for the price to drop to an area I predict and then wait for confirmation for a reversal before entering. If I hastily rush into something out of frustration it almost always ends badly

For example, right now crude oil is taking a beating, but I do not think this will continue for much longer (Price of oil almost always drops before an election, go figure).

Crude will make new highs in 2025 (my prediction), lifting all oil sector stocks.

So I have a price target around $42 for OXY, an excellent entry point.

Who is online

In total there are 1178 users online :: 14 registered, 20 bots, and 1144 guests

Registered users: JohnEdgarSlowHorses, Blackvegetable, sooted up Cyndi, Buck Naked, ROG62, RebelGator, Jantje_Smit, GHETTO BLASTER, walkingstick, murdock, Varnaj42, Deezer Shoove, BooRadley, nefarious101

Bots: ADmantX, newspaper, Not, app.hypefactors.com, axios, CriteoBot, YandexBot, GrapeshotCrawler, Yahoo! Slurp, LCC, Mediapartners-Google, Applebot, facebookexternalhit, MaxPointCrawler, semantic-visions.com, proximic, curl/7, linkfluence.com, Googlebot, bingbot