Liberal Forum

Archive

‹

Political Chat Rooms

‹

No Holds Barred Political Forum

‹

Just some Social Security FACTS for the uneducated

Just some Social Security FACTS for the uneducated

By MR-7

Yesterday 8:45 am in No Holds Barred Political Forum

Yesterday 8:45 am

Sniff and Suck voters who pandered the LIES of their FAKE news sites....

The Trump Administration will not cut Social Security, Medicare, or Medicaid benefits.

Elon Musk didn’t say that, either. The press is lying again.

What kind of a person doesn’t support eliminating waste, fraud, and abuse in government spending that ultimately costs taxpayers more?

FACT CHECK: President Trump Will Always Protect Social Security, Medicare – The White House

The Trump Administration will not cut Social Security, Medicare, or Medicaid benefits.

Elon Musk didn’t say that, either. The press is lying again.

What kind of a person doesn’t support eliminating waste, fraud, and abuse in government spending that ultimately costs taxpayers more?

FACT CHECK: President Trump Will Always Protect Social Security, Medicare – The White House

Yesterday 1:01 pm

booker was on Snuffleupagus yesterday lying about Medicaid cuts and tax cuts for billionaires...MR-7 » Today, 8:45 am » wrote: ↑ Sniff and Suck voters who pandered the LIES of their FAKE news sites....

The Trump Administration will not cut Social Security, Medicare, or Medicaid benefits.

Elon Musk didn’t say that, either. The press is lying again.

What kind of a person doesn’t support eliminating waste, fraud, and abuse in government spending that ultimately costs taxpayers more?

FACT CHECK: President Trump Will Always Protect Social Security, Medicare – The White House

any politician needs to be put down for blatant lying...end of story...

Yesterday 1:22 pm

MR-7 » Today, 8:45 am » wrote: ↑ Sniff and Suck voters who pandered the LIES of their FAKE news sites....

The Trump Administration will not cut Social Security, Medicare, or Medicaid benefits.

Elon Musk didn’t say that, either. The press is lying again.

What kind of a person doesn’t support eliminating waste, fraud, and abuse in government spending that ultimately costs taxpayers more?

FACT CHECK: President Trump Will Always Protect Social Security, Medicare – The White House

I never understood why journalist should be able to get away with lying with impunity. They say it's freedom of press. However, freedom of press also has limits. I can't yell "fire" in a movie theater. Nor can I prank call 911. Their lies cause havoc on society . No different than if someone was to cause havoc in a theater or calling 911 under false pretenses.

Retarded Horse's view on women.

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

JohnEdgarSlowHorses » Today, 7:28 pm » wrote: ↑Today, 7:28 pm

- I LOVE IT WHEN A CRACK WHORE GETS BEAT UP Image

- I WANT TO WATCH YOU BEAT YOUR CRACK WHORE WIFE Image Image Image

- PUT THAT WIFE BEATER ON AND GET BUSY

Yesterday 1:32 pm

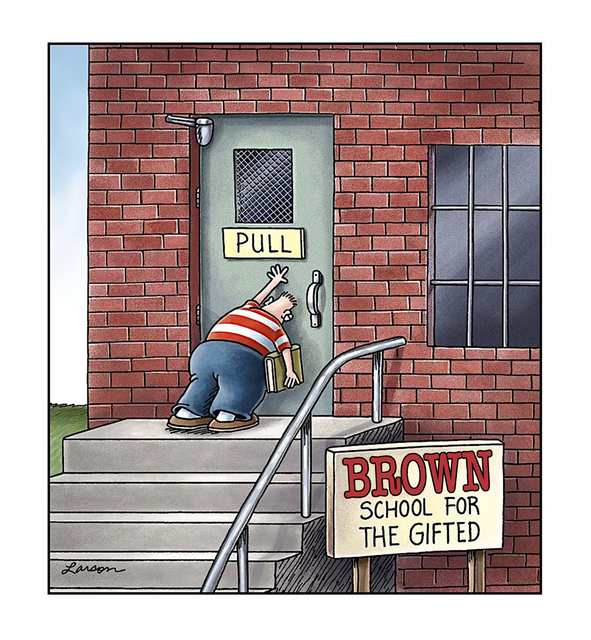

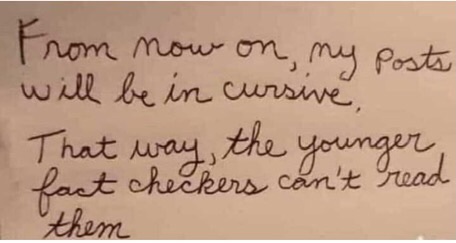

And now, we have kamala saying the fact checkers for the SS facts, will be fact checked. It's true. I can prove it.

Yesterday 1:59 pm

MR-7 » Today, 8:45 am » wrote: ↑ Sniff and Suck voters who pandered the LIES of their FAKE news sites....

The Trump Administration will not cut Social Security, Medicare, or Medicaid benefits.

Elon Musk didn’t say that, either. The press is lying again.

What kind of a person doesn’t support eliminating waste, fraud, and abuse in government spending that ultimately costs taxpayers more?

FACT CHECK: President Trump Will Always Protect Social Security, Medicare – The White House

the kind of person who sees all the money saved going to billionaires in massive tax cuts.

Yesterday 2:01 pm

Vegas » 40 minutes ago » wrote: ↑ I never understood why journalist should be able to get away with lying with impunity. They say it's freedom of press. However, freedom of press also has limits. I can't yell "fire" in a movie theater. Nor can I prank call 911. Their lies cause havoc on society . No different than if someone was to cause havoc in a theater or calling 911 under false pretenses.

logically the tax cuts for the rich will leave no money for anything else.

Yesterday 2:06 pm

kamala want's the fact checkers checkedjerrab » 8 minutes ago » wrote: ↑ the kind of person who sees all the money saved going to billionaires in massive tax cuts.

Yesterday 2:17 pm

How about giving us an example of what you are talking about. What TRUMP tax cut has the billionaires got?jerrab » 18 minutes ago » wrote: ↑ the kind of person who sees all the money saved going to billionaires in massive tax cuts.

Yesterday 2:19 pm

- harris is not even menioned.

- ------------------------------------------

- Was skewed to the rich. Households with incomes in the top 1 percent will receive an average tax cut of more than $60,000 in 2025, compared to an average tax cut of less than $500 for households in the bottom 60 percent, according to the Tax Policy Center (TPC).[1] As a share of after-tax income, tax cuts at the top — for both households in the top 1 percent and the top 5 percent — are more than triple the total value of the tax cuts received for people with incomes in the bottom 60 percent.[2]

- Was expensive and eroded the U.S. revenue base. The Congressional Budget Office (CBO) estimated in 2018 that the 2017 law would cost $1.9 trillion over ten years,[3] and recent estimates show that making the law’s temporary individual income and estate tax cuts permanent would cost another roughly $400 billion a year beginning in 2027.[4]

Yesterday 2:20 pm

MR-7 » 5 minutes ago » wrote: ↑ How about giving us an example of what you are talking about. What TRUMP tax cut has the billionaires got?

- --------------------------------------------------------

- Was skewed to the rich. Households with incomes in the top 1 percent will receive an average tax cut of more than $60,000 in 2025, compared to an average tax cut of less than $500 for households in the bottom 60 percent, according to the Tax Policy Center (TPC).[1] As a share of after-tax income, tax cuts at the top — for both households in the top 1 percent and the top 5 percent — are more than triple the total value of the tax cuts received for people with incomes in the bottom 60 percent.[2]

- Was expensive and eroded the U.S. revenue base. The Congressional Budget Office (CBO) estimated in 2018 that the 2017 law would cost $1.9 trillion over ten years,[3] and recent estimates show that making the law’s temporary individual income and estate tax cuts permanent would cost another roughly $400 billion a year beginning in 2027.[4] Together with the 2001 and 2003 tax cuts enacted under President Bush (most of which were made permanent in 2012), the law has severely eroded our country’s revenue base. Revenue as a share of GDP has fallen from about 19.5 percent in the years immediately preceding the Bush tax cuts to just 16.3 percent in the years immediately following the Trump tax cuts, with revenues expected to rise to an annual average of 16.9 percent of GDP in 2018-2026 (excluding pandemic years), according to CBO. This is simply not enough revenue given the nation’s investment needs and our commitments to Social Security and health coverage.

- Failed to deliver promised economic benefits. Trump Administration officials claimed their centerpiece corporate tax rate cut would “very conservatively” lead to a $4,000 boost in household income.[5] New research shows that workers who earned less than about $114,000 on average in 2016 saw “no change in earnings” from the corporate tax rate cut, while top executive salaries increased sharply.[6] Similarly, rigorous research concluded that the tax law’s 20 percent pass-through deduction, which was skewed in favor of wealthy business owners, has largely failed to trickle down to workers in those companies who aren’t owners.[7] Like the Bush tax cuts before it,[8] the 2017 Trump tax cut was a trickle-down failure.

Yesterday 2:24 pm

MR-7 » 10 minutes ago » wrote: ↑ How about giving us an example of what you are talking about. What TRUMP tax cut has the billionaires got?

https://www.cbpp.org/research/federal-t ... to-deliver

Yesterday 2:25 pm

2017 trump tax law? why didn't biden/harris stop it? they had 4 years. what do you mean "harris is not even menioned."jerrab » 8 minutes ago » wrote: ↑https://www.cbpp.org/research/federal-t ... to-deliver

- harris is not even menioned.

- ------------------------------------------

- Was skewed to the rich. Households with incomes in the top 1 percent will receive an average tax cut of more than $60,000 in 2025, compared to an average tax cut of less than $500 for households in the bottom 60 percent, according to the Tax Policy Center (TPC).[1] As a share of after-tax income, tax cuts at the top — for both households in the top 1 percent and the top 5 percent — are more than triple the total value of the tax cuts received for people with incomes in the bottom 60 percent.[2]

- Was expensive and eroded the U.S. revenue base. The Congressional Budget Office (CBO) estimated in 2018 that the 2017 law would cost $1.9 trillion over ten years,[3] and recent estimates show that making the law’s temporary individual income and estate tax cuts permanent would cost another roughly $400 billion a year beginning in 2027.[4]

Yesterday 3:06 pm

what did kamala say?

oh nothing.

///////////

wolves wearing sheep clothing-------------------------

https://americansfortaxfairness.org/mul ... ommittees/

,,,Average Net Worth of Republican Members on Tax-Writing Panels Is Nearly $15 million–Richest Will Save Millions from Trump CutsMultimillionaires will be making tax policy for working Americans, most prominently by pushing through extensions of the expiring provisions of the 2017 Trump-GOP tax law that mostly help them and their wealthy donors. The average net worth of the Republicans in control of the tax-writing House Ways and Means Committee and Senate Finance Committee is nearly $15 million. The wealthiest GOP members could give themselves a roughly $1.8 million annual income tax cut and their families a potential one-time estate tax cut of $22.8 million–a potential total of $24.6 million in tax cuts if they pass legislation to extend the Trump Tax bill.“The multimillionaire Republicans in charge of these key committees cannot properly represent average Americans’ tax and spending interests,” said ATF Executive Director David Kass. “Their prioritization of extending Trump’s tax scam demonstrates their disconnect from middle and working-class constituents’ needs. While wealthy Democrats also serve on these committees, they aren’t promoting continuing the entire Trump tax legislation which primarily benefits rich individuals like them and giant corporations—legislation that would add trillions to the deficit and threaten funding for Social Security, healthcare, education, housing and other vital public services. A system where millionaires vote for tax benefits favoring other wealthy elites undermines both our economy and democracy.”Of the 26 Republican members of the Ways and Means Committee, over two-thirds are worth more than a million dollars. Almost two-thirds of the Republicans on the Finance Committee are millionaires. Nine of the 39 GOP members of the two tax-writing panels are worth over $10 million. Vern Buchanan (FL), the highest-ranking GOP member of Ways and Means besides the chairman, is worth nearly a quarter of a billion dollars. -----------------------------------------------------------

foxes in the chicken house......................

Yesterday 3:09 pm

MR-7 » 48 minutes ago » wrote: ↑ 2017 trump tax law? why didn't biden/harris stop it? they had 4 years. what do you mean "harris is not even menioned."

you are the one who mentioned her.

Yesterday 3:19 pm

Yesterday 3:19 pm

ROG62 » Today, 1:01 pm » wrote: ↑ booker was on Snuffleupagus yesterday lying about Medicaid cuts and tax cuts for billionaires...

any politician needs to be put down for blatant lying...end of story...

how is tax cuts for billionaires a lie??

they freaking admit it.

Yesterday 3:23 pm

https://www.theguardian.com/us-news/202 ... nding-cutsROG62 » Today, 1:01 pm » wrote: ↑ booker was on Snuffleupagus yesterday lying about Medicaid cuts and tax cuts for billionaires...

any politician needs to be put down for blatant lying...end of story...

Yesterday 8:43 pm

what % is listed for both parties?jerrab » Today, 2:19 pm » wrote: ↑https://www.cbpp.org/research/federal-t ... to-deliver

- harris is not even menioned.

- ------------------------------------------

- Was skewed to the rich. Households with incomes in the top 1 percent will receive an average tax cut of more than $60,000 in 2025, compared to an average tax cut of less than $500 for households in the bottom 60 percent, according to the Tax Policy Center (TPC).[1] As a share of after-tax income, tax cuts at the top — for both households in the top 1 percent and the top 5 percent — are more than triple the total value of the tax cuts received for people with incomes in the bottom 60 percent.[2]

- Was expensive and eroded the U.S. revenue base. The Congressional Budget Office (CBO) estimated in 2018 that the 2017 law would cost $1.9 trillion over ten years,[3] and recent estimates show that making the law’s temporary individual income and estate tax cuts permanent would cost another roughly $400 billion a year beginning in 2027.[4]

Yesterday 8:45 pm

I wonder how she did that without smiling...

Who is online

In total there are 2779 users online :: 8 registered, 11 bots, and 2760 guests

Registered users: Two If By Tea, Buck Naked, righteous, ROG62, *GHETTO BLASTER, murdock, Cannonpointer, Deezer Shoove

Bots: proximic, YandexBot, Mediapartners-Google, Applebot, CriteoBot, ADmantX, linkfluence.com, curl/7, semantic-visions.com, bingbot, Googlebot